We think it's safe to say that even the health insurance basics can be hard to understand.

We want to help. Look inside each tab below to see shorter, and hopefully more clear, definitions of the most used and misunderstood health insurance words.

Allowed Amount

The Allowed Amount is the maximum amount that your insurance company determines is reasonable for covered services. The allowed amount includes any payments to a provider, plus any deductible, coinsurance or copayment. For in-network providers, the allowed amount is usually the amount the provider has agreed to accept as payment in full.

In other words:

Your insurance company makes a deal on price with each doctor and provider in its network. The Allowed Amount is the most the doctor is allowed to charge and the most your insurance will pay for a health care service covered by your plan.

Good to know:

If a provider charges more than the allowed amount, you may have to pay the difference.

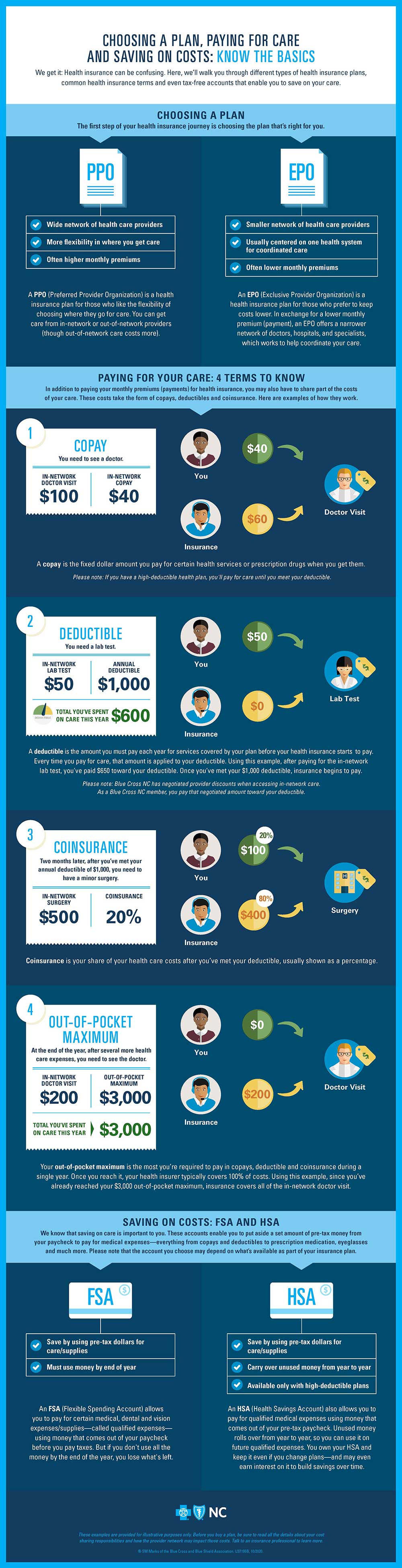

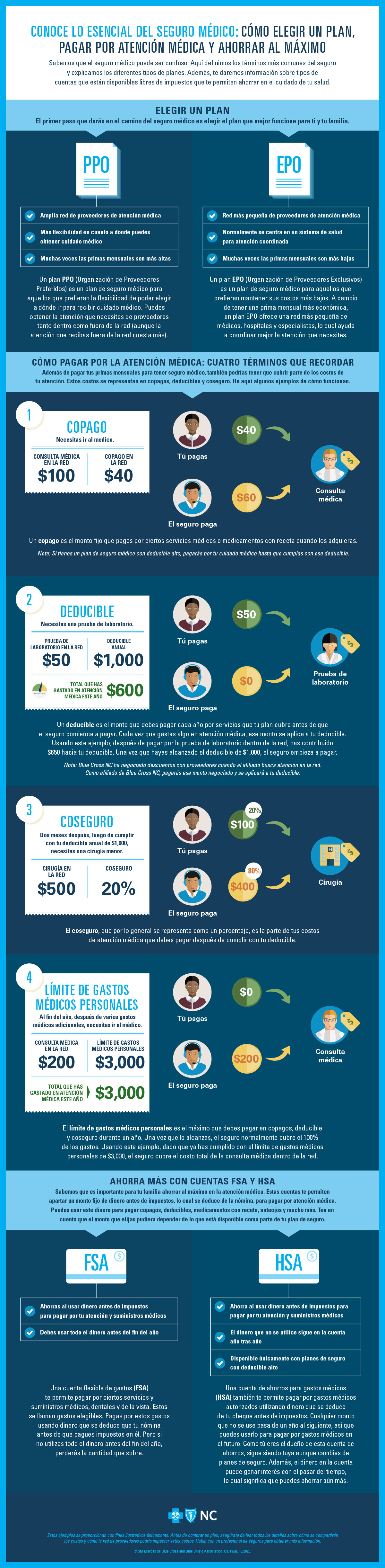

Coinsurance

Coinsurance is the sharing of costs by your insurance and you for covered services after you’ve met your benefit period deductible. Coinsurance is usually shown as a percentage.

For example, if your coinsurance is 20%, that means you'll pay 20% of covered medical expenses after you've met your deductible (and your insurance will pay 80%) until you reach your out-of-pocket limit for the benefit period (usually a year).

Once you reach the out-of-pocket limit, your insurance should pay 100% of all covered services for the remainder of the benefit period.

Blue Cross NC members can find their coinsurance percentage on the Benefits page in Blue Connect, on a member ID card or in the Summary of Benefits in their benefit booklet.

In other words:

Coinsurance is your share of the cost of a covered medical service after you’ve met your deductible for your benefit period (1 year).

Good to know:

Generally, health plans with low monthly premiums have higher coinsurance. Plans with high monthly premiums have lower coinsurance amounts.

Copayment

A Copayment is the fixed dollar amount you pay at the time a covered service is provided. Copayment amounts can vary depending on:

- The benefits or coverage included in your health plan

- What services you receive

- Using in-network instead of out-of-network doctors and hospital

- Seeing a primary care provider (PCP) instead of a specialist

- Taking generic vs. brand-name prescription drugs

In other words:

A Copayment is the set dollar amount you pay (for example, the $20 you pay when you check out at the doctor’s office) for certain medical services and prescription drugs at the time you get them.

Good to know:

Look at your member ID card. It should list copay amounts for different types of visits, like the charge for a PCP vs. a Specialist, for example. For Blue Cross NC members, this information is on the back of the ID card.

Deductible

A Deductible is the dollar amount you must pay for covered services in a benefit period before benefits are payable under a health plan. The deductible does not include coinsurance, charges over the allowed amount, amounts exceeding any maximum or expenses for non-covered services. For Blue Cross NC members, find your deductible amount on the Benefits page or read your Benefit Booklet for services that apply to your deductible.

In other words:

A Deductible is the set dollar amount you pay toward covered medical services each benefit period (typically one year) before Blue Cross NC starts paying toward those services.

Good to know:

Your copays (those fees you pay when you check out at the doctor's office) don't go toward paying down, satisfying or meeting your annual deductible amount.

EOB or Explanation of Benefits

An EOB or Explanation of Benefits shows the price of a medical service, the amount Blue Cross NC will reimburse a provider based on negotiated rates, how much your health plan paid them, and your member savings. You’ll also see how much of your deductible you've paid, and any copayments, coinsurance or other amounts you may owe. And, the EOB will show you how much you may be able to save by using in-network providers. Blue Cross NC members, try our EOB Search Tool in Blue Connect to see details about your processed claims.

In other words:

You'll get an EOB after a visit to a doctor, health care provider, pharmacy or facility. An EOB lists details of the medical services you received, like the date, amounts paid by insurance, and the cost you may owe.

Good to know:

Your EOB will come in the mail. Check it against your doctor bills to make sure all the charges are correct so you don't get any surprises later.

In-Network

An In-network Provider, hospital, doctor, other medical practitioner and / or supplier that is contracted with your insurance plan. An out-of-network provider is a provider who does not contract with Blue Cross NC and does not participate in the BlueCard® program.

In other words:

In-Network Providers are doctors, health care providers and facilities that make a deal or contract with an insurance company and participate in its programs.

Good to know:

You may pay less if you see an in-network provider. For Blue Cross members, ancillary providers outside North Carolina are considered in-network only if they contract directly with the Blue Cross and Blue Shield plan in the state where services are provided, even if they participate in the BlueCard® program.

Out-of-Pocket Limit or Maximum

The Out-of-Pocket Limit is the dollar amount you pay for covered services in a benefit period (usually 1 year) before your insurance pays 100% for covered services. The out-of-pocket limit can include your deductible, coinsurance and copays, depending on your health plan.

In other words:

The Out-of-Pocket Limit is the maximum amount you pay for health care in a year before your insurance starts paying all costs for covered services, including deductibles, coinsurance and copays (depending on your plan).

Good to know:

You can think of out-of-pocket costs like this: they're the gas, parking fees and tolls you pay on a business trip before your company reimburses you. Keep your costs lower by making sure your EOB (explanation of benefits) matches your doctor's bills.

This is important! All health plans are not the same! Your plan may be very different from what we're showing here. Before you buy a plan, be sure to read all the details about your cost sharing responsibilities and talk to an insurance professional to learn more.

Blue Connect

Blue Connect