For companies with 51 or more full-time employees

Request a Quote or browse the topics below to learn more.

Plan & Network Options

The larger the network, the more doctors and pharmacies in that network, but it also means the health plan may cost more. Leverage our insights to optimize your network and strengthen the foundation of your workforce’s health plan.

Blue High Performance Network℠ (BlueHPN℠)

Network Highlights

- 11% total cost of care savings on average compared to our industry leading PPO and up to 20% savings in some markets1

- Carefully selected network of doctors & hospitals delivering higher-quality care at lower costs

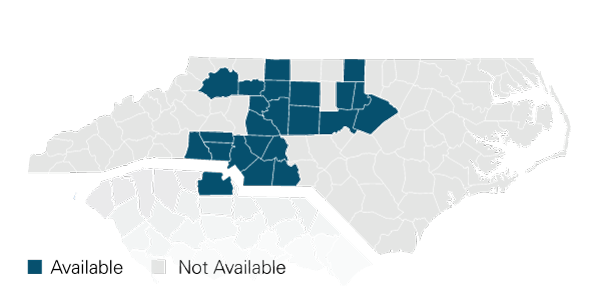

Available to residents of the Charlotte-Concord-Gastonia-York, Hickory-Statesville, Raleigh-Durham-Chapel Hill and Winston-Salem-Greensboro-High Point regions of North Carolina:*

* Market footprint for 1/1/2023. Urgent and emergent care benefits in non-BlueHPN markets. Market footprint subject to change. In the North Carolina market, BlueHPN is available to employees who live in the following counties: Alexander; Anson; Cabarrus; Caswell; Catawba; Chatham; Cleveland; Davidson; Davie; Durham; Forsyth; Gaston; Granville; Guilford; Iredell; Lincoln; Mecklenburg; Orange; Person; Randolph; Rowan; Stanly; Stokes; Union; Wake; Wilkes; Yadkin; York County, SC. Member eligibility may vary by employer. Talk to an authorized Blue Cross and Blue Shield of North Carolina (Bluue Cross NC) sales agent or representative for details.

Blue Options® PPO

Network Highlights

- Largest provider network

- Integrated Rx drug benefit

- Available in all 100 counties

Don’t Forget Dental and Vision

Employees get a simplified experience with a single ID card and portal – helping them create a total health connection.

Dental Plans

Dental makes a difference

Proper oral health affects our overall health and well-being. That’s why Blue Cross NC takes an integrated approach to dental and medical coverage. From taking care of your total health to lowering costs, integrating with us is a clear win-win for you and your employees. With each of our flexible plans, you get:

- One bill and one ID card

- A dedicated account management support team

- Broad local and national network

- One portal with access to all Blue Cross NC medical, dental and vision plans through Blue ConnectSM

- Dental care gap reminders for medical members with certain health conditions

- Options for rollover benefits, preventive not applying to the annual maximum, orthodontia with no age limit and more

Along with easy administration and access, our plans include the following covered services2 as standard benefits:

- Periodontal maintenance covered under basic services

- Composite (white) fillings covered on all teeth

- No missing tooth exclusion or limitation

- Sustained release therapeutic injections to minimize the need for opioid prescriptions

Dental Blue® PreferredSM (PPO)

- Saves money for you and your employees with lower premiums and higher benefits for staying in-network*

- Three cleanings and exams come standard – unique to Dental Blue Preferred

- Preventive Only and Preventive & Basic Only plans available

- Options available with no annual maximum on preventive services

Dental Blue®

- Indemnity-like plan with same benefit level at any provider

- Your employees can save on out-of-pocket expenses by using participating providers*

- Preventive Only and Preventive & Basic Only plans available

- Options available with no annual maximum on preventive services

Dental Blue® SelectSM (shelf-rated)

- Indemnity-like plan with reliable, steady rates because it’s community (shelf) rated

- Three plans from standard to enhanced, including options with implants and orthodontia

- Lifetime deductible your members only need to meet once

* Non-participating providers may bill members the balance for amounts higher than what is allowed for out-of-network.

Waiting periods may apply. See your quote proposal or benefit booklet for information regarding the plan you choose.

Dental Care Resource Center

The Dental Care Resource Center has the information and tools you need to get a healthy smile. Read helpful articles, get tips for good dental health, check symptoms or find answers to frequently asked questions.

Vision Plans

Blue 20/20℠ Vision Plans to Meet Your Employees’ Needs

Our Blue 20/20 plans offer your employees a wide network of vision providers. They can choose from independent eye doctors or retail chains and online vision products. Each of our plans has unique features along with great coverage for both in- and out-of-network benefits.

You can choose between employer-paid or voluntary coverage. And, if you purchase with a medical plan, you’ll get one bill and one enrollment to save you time!

Choose from Four Flexible Plan Options:3

| Blue 20/20 Exam Only | Blue 20/20 Exam Plus |

Blue 20/20 Lens & Frame Only |

Blue 20/20 Lens & Frame Plus |

| A comprehensive eye exam benefit | A comprehensive eye exam with allowance or copay benefits for materials | An easy-to-use materials allowance | An easy-to-use materials allowance paired with a routine comprehensive eye exams |

| Coverage for routine comprehensive eye exams | Coverage for routine comprehensive eye exams | Routine comprehensive eye exams NOT COVERED | Coverage for routine comprehensive eye exams |

| Allowance for frames AND a choice of a copayment for lenses OR an allowance for contact lenses | Flat dollar allowance for prescription eyeglasses or contact lenses | Flat dollar allowance for prescription eyeglasses or contact lenses | |

| Additional In-Network Savings | |||

| An average of 35% off complete pairs of prescription eyeglasses and prescription sunglasses on initial purchase, and additional pair discount of 40% off | 40% off additional complete sets of prescription eyeglasses and prescription sunglasses | 40% off additional complete sets of prescription eyeglasses and prescription sunglasses | 40% off additional complete sets of prescription eyeglasses and prescription sunglasses |

| 15% off conventional contact lenses | |||

| Discounts of 15% off retail or 5% off promo price for LASIK or PRK | |||

| 20% off select non-covered items, including non-prescription sunglasses | |||

| Special offers on Blue Connect for discounts on frames and lenses, contacts and other vision services and items | |||

Health & Wellness

Blue Connect & Blue Connect Mobile℠

Blue Connect is your personal guide to the tools you need to manage your health plan and health care.4 You can:

- View your deductible, claims and benefits in an instant

- Access important documents like your digital member ID card no matter where you are

- Get health tips, articles and videos on everything from weight loss to prescription costs to dental health

Wellness Engagement Program

Our Wellness Engagement program5 encourages participation in activities that can improve your employee’s health and well-being. Flexible reward types are available for activities like completing a Health Survey, participating in self-guided health programs and participating in the Nurse Support program.6

Blue365® Health & Wellness Discounts

Blue365 gives you access to savings across all aspects of your life – including 20% off on Fitbit® devices and over $800 off LASIK, discounts on healthy, organic meal delivery services like Sunbasket and much more!7

Preventive Care Covered Services

In-network preventive care is covered at 100%.8 Our Preventive Care Services List shows you which services and prescriptions are considered preventive and covered at 100%.

Health Line Blue℠ Nurse Line

Health Line Blue connects you to a trained nurse, 24/7, to get your health questions answered.9

Prime Therapeutics® Prescriptions by Mail

Prime Therapeutics (Prime) Prescriptions by Mail delivers a 90-day supply of medications by mail. No driving. No waiting.

See how our tailored solutions drive smarter, better health care and our personalized engagement empowers employees to make wise health care decisions.

Affordable Care Act (ACA) Requirements

Based on your company size, you may be subject to a penalty if you choose not to offer your employees health insurance.10

More information is available through the Health Insurance Marketplace at healthcare.gov.

U36098, 10/22

Blue Connect

Blue Connect