To understand health insurance, think about your car insurance...

You need your car. You buy car insurance because it helps you pay for repairs if it breaks down or you have an accident. Health insurance is a little like that.

You need your health. Health insurance helps you pay for doctors, hospitals, medications and more if you get sick or have an accident. What's more, health insurance helps you pay for preventive care, like yearly vaccinations, check ups and wellness programs, so you're less likely to become ill. You and your health insurance company become "partners" who work together to pay for your health care. This is known as cost sharing.

Copayments, Deductibles and Coinsurance are the basic elements of cost sharing.

How you pay for care at the doctor, pharmacy or hospital will depend on the cost sharing details you choose.

Get to know these common insurance words. You must know them to fully understand how your health insurance works.

Remember, you and your insurance company are partners working together to pay for your health care. Here's how that works step-by-step:

Every month you make a payment to be covered by a health plan.

Your payment is called a premium.

You might get health insurance at your job.

In some cases, your employer pays part of the monthly premium and you pay part.

(For example, maybe you pay 20% out of your paycheck each month and your company pays the other 80%.)

When you visit a doctor or health care provider, you and your insurance company share the cost, generally in one of two ways:

1. Health Plans with a Copay + Deductible + Coinsurance

2. Health Plans with a Deductible + Coinsurance (No Copay)

Health Plans with a Copay + Deductible + Coinsurance

- Sometimes you'll pay a small fee, called a copay or copayment, when you check out. Generally, copays are for doctor's office, urgent care and emergency room visits, and prescription drugs. But read your health plan details to be sure.

- Each year you'll pay your deductible. (Copays don't count toward paying your deductible.) You'll pay for any services or supplies not covered by a copay, when you check out, until you've met your deductible for the plan year.

- Each year you'll pay your coinsurance. After you meet your deductible, then you pay part of the bill (say 20%) and your insurance pays part of the bill (say 80%) until you've paid your coinsurance for the plan year.

- Your Copay + Deductible + Coinsurance = Your Out-of-Pocket Maximum (Together, this is the most you'll pay during the plan year.)

- Finally, your insurance starts paying 100% of your health bills until the plan year ends or you change insurance plans.

People generally buy a plan with copays so they have a better idea of the cost of each visit before they go.

Plans with copays can be more expensive, but are a good choice if you know you'll need to visit the doctor a lot.

Health Plans with a Deductible + Coinsurance (No Copay)

- Each year you'll pay your deductible. You'll pay for any services or supplies, when you check out, until you've met your deductible for the plan year.

- Each year you'll pay your coinsurance. After you meet your deductible, then you pay part of the bill (say 20%) and your insurance pays part of the bill (say 80%) until you've paid your coinsurance for the plan year.

- Your Deductible + Coinsurance = Your Out-of-Pocket Maximum (Together, this is the most you'll pay during the plan year.)

- Finally, your insurance starts paying 100% of your health bills until the plan year ends or you change insurance plans.

People generally buy a plan without copays because they are generally less expensive.

This is a good choice if you're relatively healthy and don't need to visit the doctor a lot.

The doctor bills your insurance company.

- Doctors don't generally get the full cost of their services.

- Your insurance negotiates a lower rate for you from your doctor.

- The doctor joins your insurance company's network of health care providers and agrees to charge less so you pay less. This is called being in network.

- If you choose a doctor who is out-of-network, and not a partner with your insurer, you may have to pay part or all of the bill yourself.

Your insurance pays your doctor.

- Your insurance and the doctor have agreed to a set price for the health services you get.

- This is called an allowed amount.

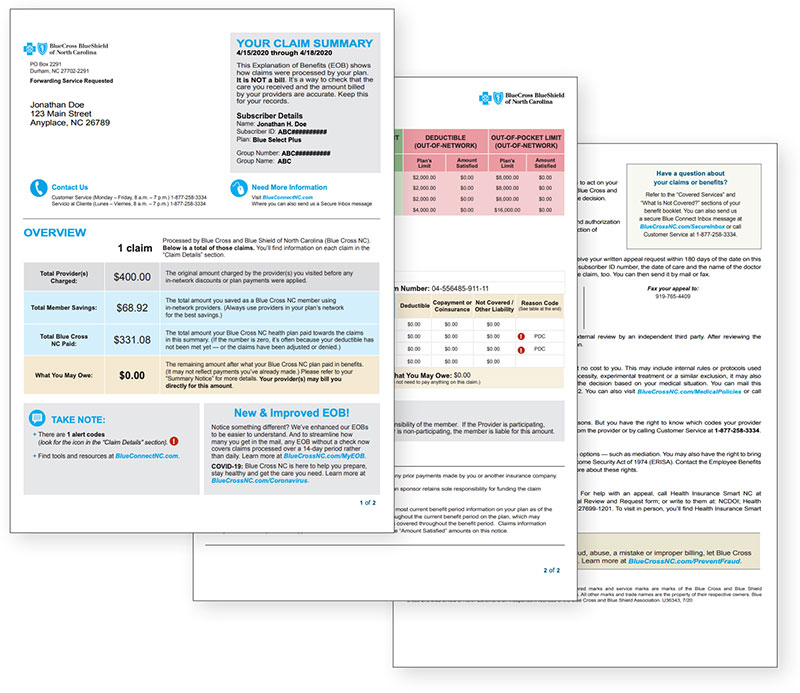

Your insurance company will send you an Explanation of Benefits or EOB.

This is a chart that shows the amount:

- your doctor billed you

- your insurance allows the doctor to bill you

- your insurance paid the doctor

- you saved

- you owe if you haven't paid your deductible or coinsurance

This is important! All health plans are not the same! Your plan may be very different from what we're showing here. Before you buy a plan, be sure to read all the details about your cost sharing responsibilities and talk to an insurance professional to learn more.

Blue Connect

Blue Connect